How thousands of Millionaires donít pay Income Tax

About 46

percent of all tax filers (individuals or households)

pay no federal income taxes because

of various exclusions.

High-income tax filers make up a tiny portion of that

number, but they are by far the biggest

beneficiaries.

Over $298 billion vs $61 billion !

More than half of the tax revenue lost to

the most common tax exclusions stays

in the pockets of the

richest one-fifth of Americans,

according to an analysis by the Congressional Budget Office.

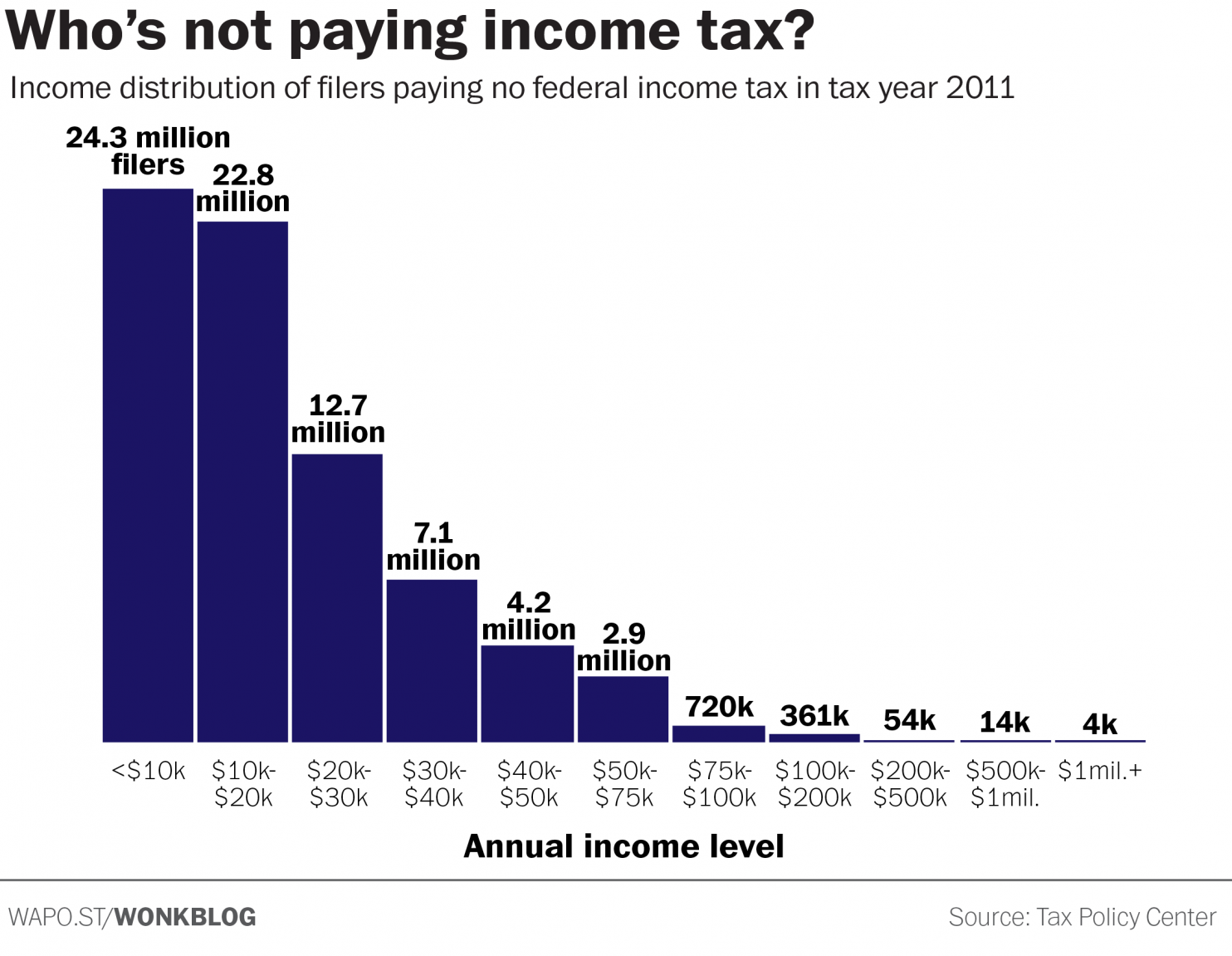

In 2011 about 433,000 tax filers with incomes over

$100,000 paid no federal income tax, according to

estimates based on limited IRS data by

the Tax Policy Center, a nonprofit think tank.

That number includes approximately 4,000 filers with

an income of $1 million or more.

Most low-income filers ó those with a pretax

income of $20,000 or less ó who paid no tax did so because they made just

enough to cover family expenses, or less.

Many also benefit from the Earned Income Tax Credit,

which offers a payment to low- and moderate-income workers. That

cost the government about $61 billion in

forgone tax revenue in 2013, according to the CBO.

By contrast, high earners who paid no tax

were primarily able to do so because of a wide array of other special

provisions in tax law. Roughly 1,000 of the 4,000

millionaire non-payers in 2011 did so because their income

that year was locked away in

individual retirement accounts not subject

to federal taxes, according to Roberton Williams of the Urban

Institute, one of the authors of the Tax Policy Center analysis.

At an annual cost of $137 billion annually,

the tax exclusion for pension contributions was

more than twice as expensive as the

Earned Income Tax Credit. |

|

Oxfam blamed tax havens in its

2016 annual report on income inequality for much of the widening gap

between rich and poor. "Tax havens are at the core of a global system

that allows large corporations and wealthy individuals to avoid paying their

fair share," , "depriving governments, rich and poor, of the resources they

need to provide vital public services and tackle rising inequality."

At least 2,400 US-based clients were found in the Panama Papers....,

Mossack Fonseca offered advice to many of its US clients on how to evade

US tax and financial disclosure laws.

Donald Trumpís allies in the Paradise Papers ( including the

Koch Brothers and

Robert Mercer )

18 Hypocritical CEOs: Receiving Bailouts,

Outsourcing Jobs & Evading Taxes

Tax documents obtained by the New York Times show that Donald Trump declared a

massive net operating loss of $916 million in

1995, enough to allow him to avoid paying federal

income taxes for up to 18 years. The documents shed light

on provisions in the U.S. tax code that allow wealthy individuals to avoid

income tax payments even in years when they make millions.

In 1995, Trump declared $3.4

million in business income, $7.4 million in interest income, and close to

$100,000 in income from other sources such as dividends, taxable refunds and

wages. But this income was more than offset by

hundreds of millions of dollars in reported losses

from real estate and "the financial wreckage he left behind in the

early 1990s through mismanagement of three Atlantic City casinos, his

ill-fated foray into the airline business and his ill-timed purchase of the

Plaza Hotel in Manhattan," according to the Times. |

| |

|

Another significant chunk of the 4,000 high-income

non-filers made their money from interest on municipal bonds, which is not subject to federal

income tax. Reduced tax rates on

capital gains were also one of most costly

federal tax provisions: $161 billion.

Calculating the cost of the 10 largest tax expenditures ó the exclusions, deductions and

credits allowed through the tax code ó the 2013 CBO report found that the top 20%

of earners were the biggest beneficiaries.

The CBO report didn't include "net operating loss"

in its calculation of top tax expenditures. But as Trump

shows, it can be a major boon.

People like Trump who work in

real estate can use real

estate losses to offset gains or income from elsewhere,

according to Williams. For real estate developers,

"your business is such that you're more likely to generate losses in the short

run, and the government is going to allow you a way of

deferring your taxes while you're in a losing situation,"

Williams said.

But, he added, often times "these are paper losses, not

real losses." The tax code allows property owners in the

real estate business to claim losses from things

like depreciation even if the property itself is

gaining market value. Williams

says these provisions are not necessarily problematic or harmful on their own,

and that they weren't created with the intention of allowing

wealthy people to avoid

paying taxes indefinitely. But the complexity

they add to an already-complex and massive tax code can erode people's trust in

the fairness of the tax system. "Right now we have an extremely complex tax code

that literally nobody understands," Williams said

in an interview. "That's not right. The reasons that isn't right is not so much

that the provisions themselves are wrong, but rather that we don't understand

why we're paying what we do." This complexity can lead to suspicion of wealthy

non-taxpayers, like Trump. And it can just as

easily lead to suspicion of low-income people who don't pay tax either.

"HALF of Americans don't pay income tax despite crippling govt debt,"

Trump tweeted

in 2012.

Trump was one of them.

More:

The most shocking part of Donald Trumpís tax

records isnít the $916 million loss.

It's non-existent DEPRECIATION

What the government does for people like Donald Trump

that it wonít do for the poor

A new study says Trump would raise taxes for

millions. Trump's campaign insists he won't.

Why the world's third-richest man is attacking

Donald Trump

A strange but accurate predictor of whether someone supports Donald

Trump

source Washington Post, By Christopher

Ingraham, October 2016

|